Back in November last year we reached out to our Good Finance users to understand what they were really thinking (blog here). Three years into our existence, and having reached the milestone of reaching 200,000 unique users, we wanted to check we are still providing the information which serves our users in the best way possible.

The Process

We have now completed this process which consisted of:

- Step one: detailed deal research & data-mapping in order to understand the changing landscape of social investment

- Step two: user-surveys in order to lay the foundations and gain a base layer of understanding for what our users really want

- Step three: in-depth interviews to gather insight and to deep dive into experiences and attitudes and how we can better support you on your social investment journey.

Here is a snapshot of what we found:

User-surveys

In total we received 110+ survey responses covering a variety of different Good Finance users from all over the UK. We learned that:

- Our users have a strong preference for websites, Facebook and Twitter with regards to engagement tools. This will help to inform our engagement strategies and reach going forward.

- Our users have a high level of curiosity and interest in learning more about social investment. Each user persona has different levels of understanding, however overall we learnt that it is important to continue to demystify social investment and showcase a breadth of options; providing materials and resources to continue to support you on this journey and by sharing relatable case studies.

- Our users are wanting to pursue long term financing solutions with investors who share their values

- Out of total 111, we also surveyed 34 users who hadn’t heard of Good Finance before and learnt their preferences, experiences and risk appetites were all different to those who had already interacted with the Good Finance platform!

In-depth interviews

To follow-up from the survey responses, we undertook 24 additional conversations with consideration to include diversity, geography and knowledge with the objective to gain further insight and background on the attitudes around the investment landscape.

Funding routes are being reassessed: After the impact of the pandemic focus in 2021 is on longer-term solutions. For many this involves a heightened focus on building revenue streams

But what does this all mean?

At the time of Good Finance’s launch, three key personas were identified as those who prioritised seeking information and guidance about social investment. For each persona a brief description of their needs and challenges was developed, and a user journey was constructed to reflect the engagement and interaction they were likely to have with Good Finance.

- ‘Business savvy’, knows about investment and wants quick connections to the right opportunities

- ‘Go-getter’, social mission will always be a main driver, but financial resilience and commercial viability is also important

- ‘Grass roots’, new to social investment and passionate about making a change in their community.

- NEW “The shape shifter”, an emerging persona that shows a good grasp of the funding and finance market, but with the shifting shape of the landscape, they have an increasing focus on social investment as a tool to diversify funding

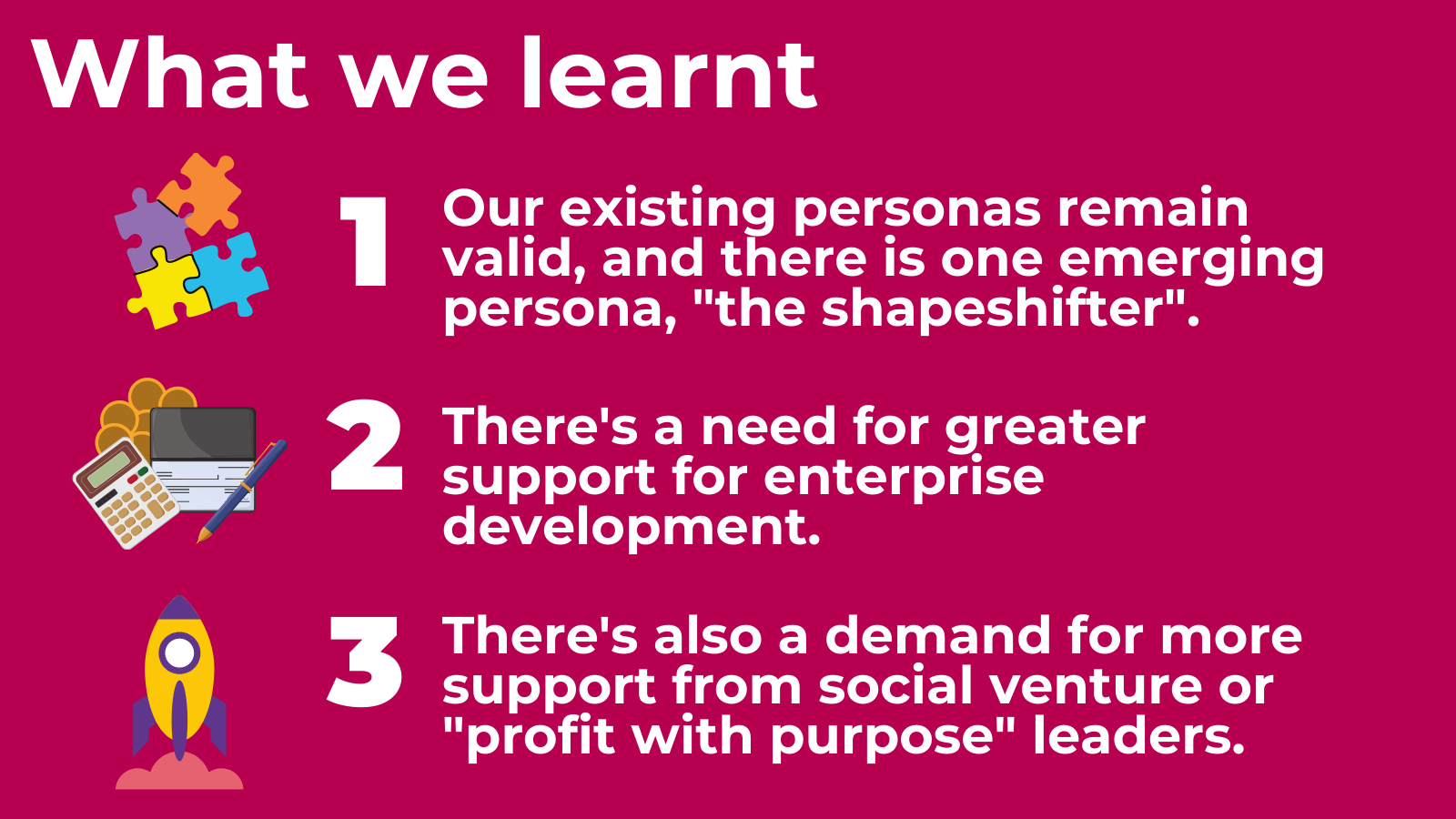

Our findings and user insight has shown that our existing personas remain relevant as our primary target audience for Good Finance, but with the addition of a fourth primary user persona.

Our research also identified a need for greater support for those users who were seeking information about becoming more enterprising (as a precursor to exploring social investment) and greater support also for social entrepreneurs running social ventures (sometimes referred to as profit with purpose businesses).

With 110 responses and 24 interviews completed, we have taken all experiences and insights into consideration. Having identified emerging personas and needs, we now move to how we can incorporate this user insight into our strategy.

In 2021, we’ll be exploring how we can continue to improve the Good Finance platform, our mission remaining at the core, and our user-centred and collaborative ethos driving the direction of travel.

To our users and all those who supported this process by sharing their time, wisdom and insight - thank you. The results will feed directly into the development of the current and future content, functionality and services of Good Finance so please keep your eyes peeled!