Emily Liddle is the Senior Communications and Engagement Officer for the Social Sector Engagement team at Big Society Capital. Manprit Vig joins Big Society Capital as the first 2027 Associate. 2027 is a new, paid training programme that prepares brilliant professionals from working class backgrounds for decision making roles in the grant-giving sector.

We believe that the funding and finance sector must ensure that organisations working with racialised communities have equal access to social investment.

At Good Finance, we can support this through providing knowledge and tools to educate. We believe the most successful way to do this is to work inwards from the margins and trial new ways of community-based engagement to address deep-rooted inequality.

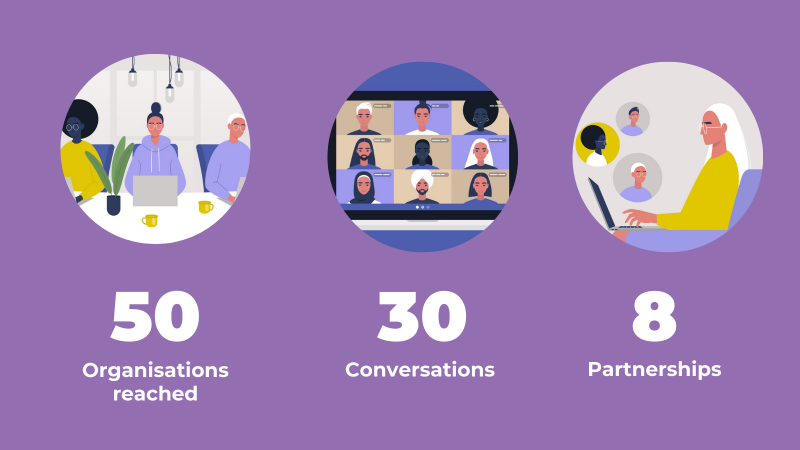

6 months ago, we launched Addressing Imbalance, our engagement programme that exists to connect with Black and ethnic minority led organisations. The aim is to work in partnership to improve access to information, knowledge and resources on social investment. Half a year on, in this post we share out learning from shaking up the sector.

It is a deeply difficult time for the social sector, we have heard that loud and clear. Yet, for many for Black and ethnic minority led organisations, this is not new. Striving to grow your organisation, raise funds and campaign for change is much harder when operating in a sector that is sustained by systemic inequalities - and always has been.

From both mine and Manprit’s own perspectives, we have learnt alot from the process. Firstly from the brilliant people that we have spoken to, many of which are now our Addressing Imbalance partners. Secondly, we have learnt alot from one another and how our own lived experiences have allowed us to navigate this phase of the programme and we wanted to share some of our insight with you.

Capacity

It won’t come as a surprise to say that capacity - and the multiple layers of capacity challenges - remains one of the biggest barriers in engaging in the conversation on social investment.

Issues with capacity came up in almost every conversation that we had. For some organisations, capacity was a barrier to taking part in the programme, even if the desire to expand social investment knowledge was there. For other organisations, with resources stretched and demands on time too great, there simply wasn’t the headspace to learn. It was clear that the focus on time and energy is just as important as focus on operational capacity.

Representation

Most of the organisations that we spoke to welcomed the programme and its root aim to improve access to social investment knowledge for Black and Ethnic Minority led charities and social enterprises.

During many of our conversations we spoke about the lack of diversity across the social investment sector and the steps it has to take to be more representative. From a racial perspective, but also across many intersections, from class, gender, geography and disability status.

Representation really does matter, especially when it comes to making investment decisions in investment committees, for example. If people who are making decisions about investment deals aren’t from racialised communities or don’t work within them, can the extent of the challenges faced from organisations on the ground who are seeking investment be truly understood?

Language

As someone who doesn’t come from a financial background, language and jargon in social investment is something I can relate to on many levels.

As we spoke to many charity and social enterprise leaders about breaking down barriers to accessing investment, we agreed that language is extremely important. Even the term social investment is perceived, for some, as a negative.

We had rich conversations about how we can flip the narrative, so when we’re talking about social investment, we frame our conversations around sustainability for the future and creating positive, transformative change. The Good Finance Jargon Buster is a great tool designed to educate, encourage and inspire you to better navigate the world of social investment.

Fluidity and agility

From the outset of the Addressing Imbalance programme, it has always been agile and fluid in its approach.

When we say it’s a partnership, we mean it’s a partnership. We work together with our partners at a pace that works for them. We don’t impose deadlines or any hard and fast requirements - just that there is an appetite to learn and grow, together. The role of Good Finance in this partnership is to bring resources, tools and knowledge. We are working collaboratively with each partner to design a programme of work that suits their needs, taking a user-centred approach first and foremost.

Our approach is based on openness and trust. It is also brand new, so there have been hiccups along the way and it certainly isn’t textbook programme delivery. Yet, our partners appreciate our flexible approach and commit to equitable relationships.

Consistently, through our engagement work, we have been inspired by the dedication in each organisation to rebuild and reimagine services for the benefit of their local communities. They each bring new ideas and perspectives of how we can shake up the social investment conversation.

Our social sector experience

Neither Manprit or I come from the finance sector and our deep-rooted understanding of working frontline framed so many of our conversations from the outset. Whilst that’s not to say that someone with a financial background doesn’t have valuable experience, yet opening up our conversations with similar and relatable experience allowed us to dig deeper into some of the challenges and the opportunities that social investment can offer.

The events of last year and the calls for a global response to tackle racial injustice has rightly forced many organisations to think deeper about their own efforts to tackle systemic racism. For us, conversations and questions simply don’t go far enough and we are in no doubt that it is primarily the responsibility of organisations like ours, working within the social investment sector, to change how we engage.

When establishing Addressing Imbalance we were clear that this project should not be a moment in time, but built on collaborative and sustainable approaches to encourage more diverse thought and experience across the social investment sector.

What’s next?

- We will be working with our Addressing Imbalance partners over the course of 2021. You can find out about our Addressing Imbalance partners here.

- Check out our newly launched Diversity and Inclusion hub here.

- Our social investment jargon buster is a great resource breaking down the complex language across the sector, you can find this here.